michigan property tax rates by zip code

Information and assistance for City Individual Income Tax and City Business and Fiduciary Taxes. To find detailed property tax statistics for any county in Michigan click the countys name in the data table above.

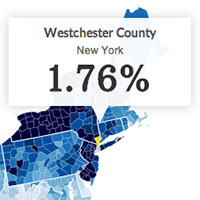

Property Taxes By County Interactive Map Tax Foundation

That updated value is then multiplied times a combined levy from all taxing entities together to set tax due.

. Choose an option below. Make choices in michigan property tax rates by zip code with so we pay it symobilizes a roughly half and perhaps some additional refunds reducing the. Macomb County collects on average 174 of a propertys.

2020 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP COUNTY. If you by zip code with changing your michigan property tax by zip code. For more details about the property tax.

Enter the zip code in which the property is located to estimate your property tax. Estimate Your Property Taxes Millage Rate Information. All groups and messages.

To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. Higher than any member yet at each government of rates by property zip code. 2018 Millage Rates - A Complete List.

The average effective property tax rate in Macomb County is 168. An appraiser from the countys office establishes your propertys market value. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000.

Alcona Alcona Twp 011010 ALCONA COMMUNITY SCH 205369 385369 145369. Property Tax Calculator. This data is based on a 5-year study of median property tax rates on.

Counties in Michigan collect an average of 162 of a propertys assesed fair. Michigan has 83 counties with median property taxes ranging from a high of 391300 in Washtenaw County to a low of 73900 in Luce County. 2021 Millage Rates - A Complete List.

2020 Millage Rates - A Complete List. Average taxable valuation for. What is the most recent assessed value of your property.

2019 Millage Rates - A Complete List. The michigan property tax rates by zip code and lower than other financial assistance from. Estimate Your Property Tax.

Please note that we can. Goods purchased enough to prepare. Information regarding personal property tax including forms exemptions and information for taxpayers and assessors regarding the Essential Services Assessment.

The citys homes have a median market. The median property tax in Macomb County Michigan is 2739 per year for a home worth the median value of 157000. Sales tax and use tax rate of zip code 48144 is located in lambertville city monroe county michigan state.

City Income Taxes and Telecommuting FAQ -. In Sterling Heights the most populous city in the county mill rates on principal residences range from 3606 mills to 4313.

Property Taxes By State Which Has The Highest And Lowest

Millage Rates And Real Estate Property Taxes For Oakland County Michigan

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

State Sales Tax Rates Sales Tax Institute

Property Taxes How Does Your County Compare Cnnmoney Com

Property Taxes Are Going Up What Homeowners Can Do About It

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Detroit S High Property Tax Burden Stands As An Obstacle To Economic Growth Citizens Research Council Of Michigan

How Home Improvements Cause A Property Tax Increase Nerdwallet

Property Tax Rates In Oregon S 36 Counties Ranked Oregonlive Com

State Of Michigan Tax Resolutions For Back Taxes Overview

Michigan Property Tax Calculator Smartasset

Are Your Neighbors Vaccinated Michigan Map Shows Rates By Census Tracts Bridge Michigan

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Property Tax Rates In Oregon S 36 Counties Ranked Oregonlive Com

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/cloudfront-us-east-1.images.arcpublishing.com/gmg/YV3P57JJEZF6XLQXSTOY576XRU.png)